21-Oct-2021

Standard Bank’s current offer of 10.55% looks to beat all other fixed deposit rates on offer. But is this really the case? In this article, I will dig into the terms attached to this offer & why it is important to compare the same type of rate when shopping for fixed deposits.

Standard Bank advertises a 10.55% rate

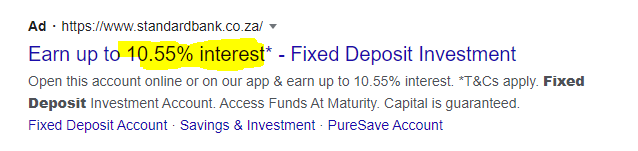

Standard Bank is currently promoting their fixed deposits. “Earn up to 10.55% interest” it says in one of the most widely displayed ads.

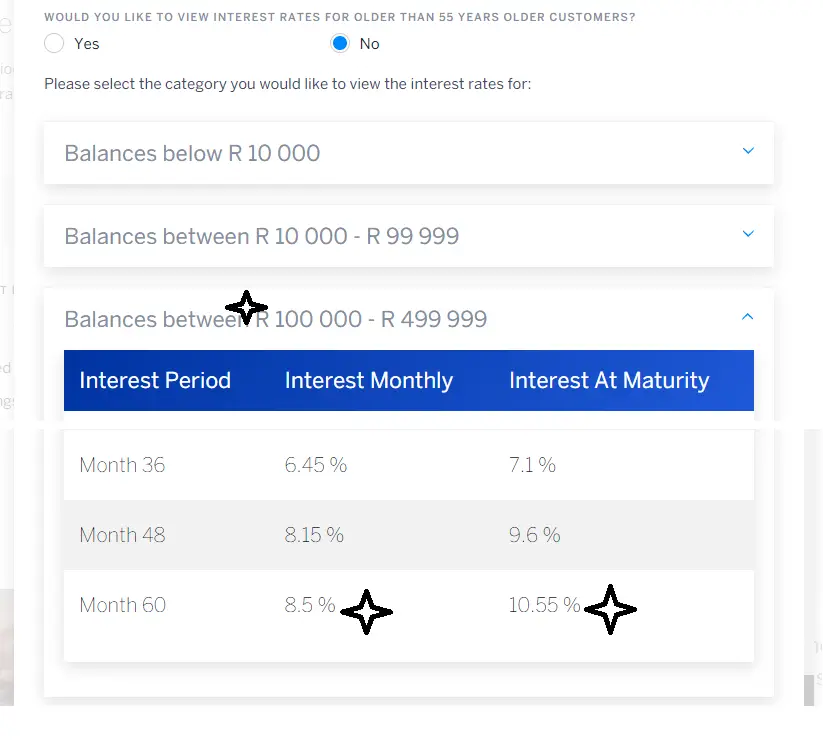

However, for the exact same terms, they also show a 8.5% rate. If you browse to Standard Bank’s fixed deposit page and go one step further by clicking on [See Interest Rates], you will get a table of all the different interest rates on offer. See below picture.

You can choose to see interest rates for customers younger or older than 55 years. The interest rates also differ depending on your investment amount. You will find the 10.55% interest rate under the R100 000 - R499 999 category.

The following is clear. Firstly, this 10.55% offer applies to individuals of any age - regardless if you are younger or older than 55. You must deposit at least R100 000 to get this rate. And lastly, you must deposit this for 60 months - ie five years.

But, 10.55% is marked as [Interest At Maturity]. And next to it is another number 8.5%. This one is marked as [Interest Monthly]. Ok, why are they showing two numbers? 8.5% is significantly less than 10.55%. And why is this website - ratecompare.co.za - currently showing 8.84%?

Same, same - but different

Banks typically show the interest rates using one of the below methods.

-

Simple or Interest at Maturity - the interest you receive at maturity.

-

Nominal - the annual rate you receive - without any compounding.

-

Effective annualised rate - the annual rate you receive - taking into account the compounding effect

[…] when making your investment choices you cannot look purely at the rate quoted on different investment alternatives. You should be sure to compare rates of alternative investments considered using the same compounding periods. This way you will be assured that you are comparing apples with apples.

Source: Nedbank - Interest rates explained

In this case, Standard Bank is advertising the [Simple] or [Interest at Maturity] rate. Once you dig into their website a bit, they also show the [Nominal] rate in their tables. So, we know that banks will show different types of rates on their website. But, why is it important?

When comparing rates you need to compare the rates using the same methodology. As Nedbank’s Interest rates explained paper points out, it will be important to compare the rates using the ”same compounding periods”. That is, we need to compare the same type of rate across banks. We either need to compare Standard Bank’s 10.55% - the simple rate & compare that to other banks’ simple rates. Or use the nominal rate 8.5%. Or use the effective annual rate. Frustratingly, banks show different types of rates. Some show nominal. Others show effective annual rates. Some show simple rates. Pick one - before you compare it to another rate. Maya on Money prefers “nominal rates”. As Maya points out in her Understanding interest rates article , “The best way to compare rates is to compare the nominal interest rate, as that doesn’t take the length of time invested into account.”

As you will see shortly, the “length of time” is also applicable to effective annual rates. It does not matter as much which type of rate you choose, but that you choose the same type of rate. (I chose to show effective annual rates on this website. But quite honestly, I could also have gone for nominal rates. The choice does not matters. What matters is that it is consistent.)

But, the different methodologies used are still confusing. And what really matters is “the actual rand interest you will have received over the period of time”, as Maya mentions in her article Understanding interest rates.

“Ideally you should ask the bank for a quote showing you the actual rand interest you will have received over the period of time for which you want to invest.”

Maya on Money, Understanding interest rates

But let us pull of this together into one example. I will show you the different rates. And the total interest earned on Standard Bank’s 10.55% offer.

Summary

- Standard Bank advertises a 10.55% interest rate

- As we found out this rate is known as a [Simple] or [Interest At Maurity]

- The equivalent nominal rate is 8.5%

- The equivalent effective annual rate is 8.84%

- The nominal, effective annual & simple rate all give you the same amount of total interest earned on your original R100 000. The rate % differ because the “methodology” used to calculate these differs.

- Therefore when comparing it is important to compare the same type of rates across banks